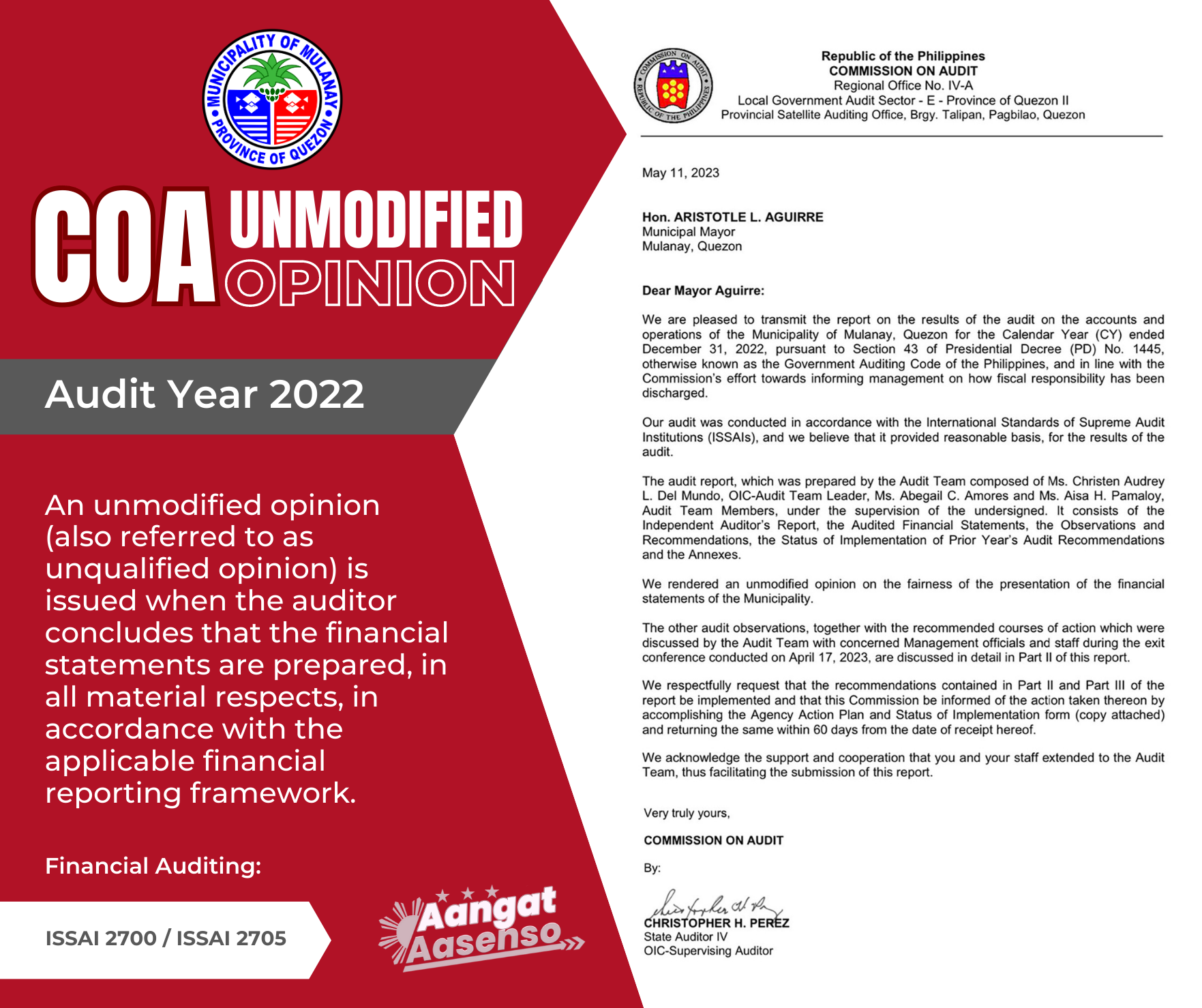

MULANAY, nakamit ang “UNMODIFIED OPINION” mula sa COA.

Ito ay pagpapatunay na maayos na naiulat ang tamang paggastos ng pondo ng bayan.

Understanding a Government COA Unmodified Opinion

A Government COA unmodified opinion is the highest form of assurance given by external auditors on a government entity’s financial statements. It signifies that the auditors have conducted a comprehensive examination of the financial records, transactions, and supporting documentation and found them to be accurate, complete, and in compliance with the relevant accounting standards and regulations. An unmodified opinion affirms that the financial statements present a true and fair view of the government’s financial position and performance.

The Importance of a Government COA Unmodified Opinion

- Public Trust and Confidence: A Government COA unmodified opinion is a powerful tool for promoting public trust and confidence in the government’s financial management. It assures citizens that their tax are being managed responsibly and that the government is being held accountable for its financial actions. This trust fosters a positive relationship between the government and its constituents.

- Accountability and Transparency: An unmodified opinion reinforces the government’s commitment to accountability and transparency in financial reporting. It demonstrates that the government entity has maintained accurate and reliable financial records, adhered to established accounting principles, and complied with regulatory requirements. This level of transparency helps prevent financial mismanagement and unethical practices.

- Access to Financing: Government entities often rely on external financing to support public projects and initiatives. An unmodified opinion on their financial statements enhances their credibility and creditworthiness in the eyes of lenders and investors. It improves the chances of obtaining favorable financing terms and ensures that the government can access the necessary funds for public welfare and development.

- Effective Resource Allocation: A Government COA Unmodified Opinion enables policymakers and government officials to make well-informed decisions regarding the allocation of public resources. It provides an accurate and reliable basis for evaluating the efficiency and effectiveness of government programs, identifying areas for improvement, and making strategic financial decisions that benefit the public interest.

- Compliance with Legal and Regulatory Frameworks: Governments are subject to various legal and regulatory frameworks that govern financial management and reporting. An unmodified opinion confirms that the government entity has complied with these requirements, reducing the risk of legal and financial penalties. It also helps protect the government’s reputation and integrity in the eyes of the public and other stakeholders.

+ There are no comments

Add yours